Exactly How Livestock Threat Protection (LRP) Insurance Policy Can Protect Your Animals Investment

In the realm of animals investments, mitigating dangers is paramount to making certain financial stability and growth. Animals Danger Protection (LRP) insurance policy stands as a trusted shield versus the unforeseeable nature of the marketplace, providing a strategic strategy to protecting your properties. By delving into the complexities of LRP insurance and its diverse advantages, livestock producers can strengthen their financial investments with a layer of safety and security that goes beyond market variations. As we discover the world of LRP insurance policy, its role in securing livestock investments comes to be increasingly apparent, guaranteeing a course towards lasting economic strength in an unpredictable market.

Comprehending Animals Threat Protection (LRP) Insurance Coverage

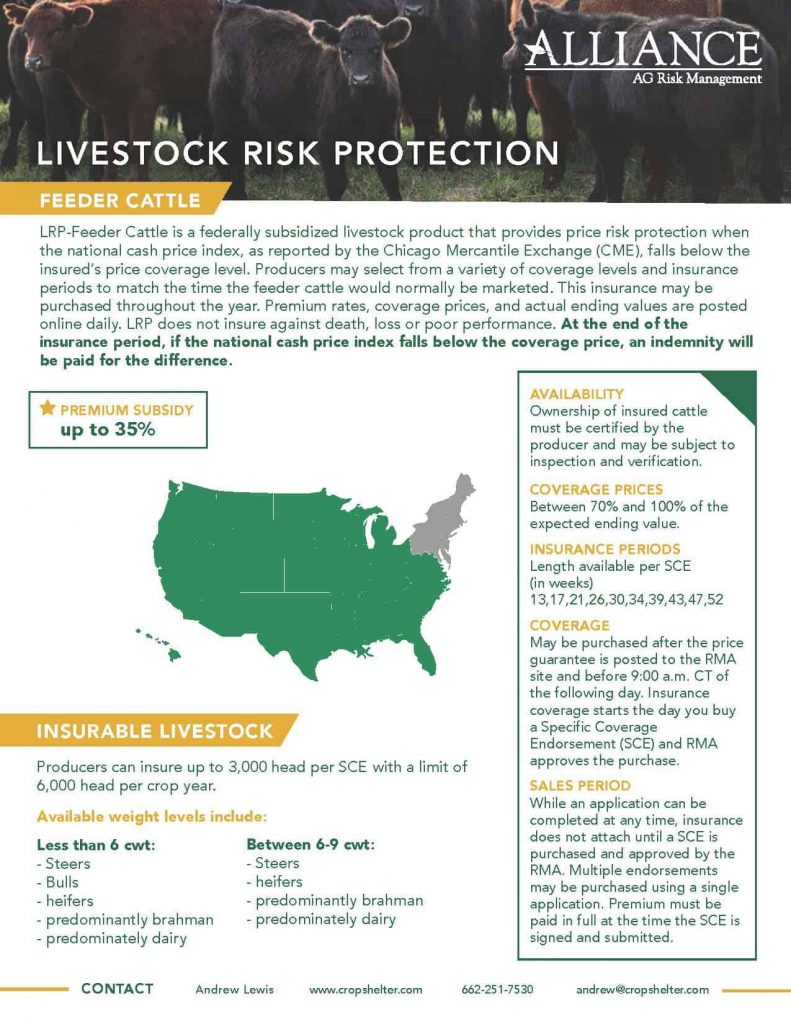

Recognizing Livestock Danger Defense (LRP) Insurance coverage is vital for livestock manufacturers looking to alleviate financial threats related to cost changes. LRP is a federally subsidized insurance item made to safeguard producers against a decrease in market value. By supplying coverage for market value declines, LRP assists manufacturers secure a flooring cost for their livestock, ensuring a minimal level of earnings despite market changes.

One secret element of LRP is its adaptability, permitting manufacturers to personalize coverage levels and policy lengths to fit their specific demands. Manufacturers can pick the number of head, weight range, insurance coverage rate, and protection duration that line up with their production goals and take the chance of resistance. Recognizing these customizable choices is crucial for producers to successfully manage their cost threat direct exposure.

In Addition, LRP is offered for numerous livestock types, including cattle, swine, and lamb, making it a functional danger management tool for livestock manufacturers throughout different industries. Bagley Risk Management. By acquainting themselves with the complexities of LRP, manufacturers can make enlightened decisions to guard their financial investments and make certain monetary security in the face of market uncertainties

Advantages of LRP Insurance Policy for Animals Producers

Livestock manufacturers leveraging Livestock Threat Security (LRP) Insurance coverage obtain a strategic advantage in protecting their financial investments from price volatility and securing a stable financial footing amidst market uncertainties. One vital advantage of LRP Insurance is rate defense. By establishing a flooring on the price of their animals, producers can alleviate the danger of considerable monetary losses in case of market downturns. This allows them to plan their budgets more effectively and make educated choices concerning their procedures without the continuous worry of price fluctuations.

Furthermore, LRP Insurance policy supplies manufacturers with satisfaction. Knowing that their financial investments are safeguarded versus unanticipated market changes enables producers to concentrate on other aspects of their organization, such as improving animal health and wellness and welfare or maximizing manufacturing processes. This comfort can cause raised efficiency and profitability over time, as producers can run with even more self-confidence and security. Generally, the advantages of LRP Insurance policy for livestock producers are substantial, using an important device for taking care of threat and ensuring financial safety and security in an uncertain market environment.

How LRP Insurance Coverage Mitigates Market Risks

Alleviating market dangers, Livestock Danger Security (LRP) Insurance gives animals producers with a dependable guard against price volatility and economic uncertainties. By offering defense against unanticipated cost drops, LRP Insurance policy assists producers protect their investments and preserve financial security despite market variations. This type of insurance policy enables animals manufacturers to secure a rate for their animals at the start of the plan period, making certain a minimum rate level despite market changes.

Actions to Secure Your Livestock Investment With LRP

In the world of agricultural danger monitoring, executing Animals Threat Protection (LRP) Insurance coverage entails a tactical procedure to guard investments against market changes and unpredictabilities. To safeguard your animals financial investment efficiently with LRP, the initial step is to examine the specific threats your procedure deals with, such as rate volatility or unanticipated climate events. Next, it is important to research study and select a respectable insurance policy supplier that offers LRP policies tailored to your animals and service demands.

Long-Term Financial Protection With LRP Insurance

Ensuring enduring financial security through the utilization of Animals Threat Defense (LRP) Insurance policy is a sensible long-lasting see it here method for farming manufacturers. By integrating LRP Insurance coverage into their danger administration strategies, farmers can guard their animals financial investments against unexpected market fluctuations and adverse occasions that could threaten their monetary health in time.

One secret benefit of LRP Insurance for lasting economic safety and security is the assurance it supplies. With a trusted insurance coverage plan in place, farmers can mitigate the economic dangers related to unpredictable market conditions and unexpected losses as a result of aspects such as disease episodes or natural disasters - Bagley Risk Management. This security enables producers to concentrate on the day-to-day procedures of their livestock organization without continuous fret about potential economic obstacles

Furthermore, LRP Insurance supplies an organized method to taking care of danger over the long-term. By establishing certain coverage degrees and selecting ideal endorsement durations, farmers can customize their insurance coverage intends to align with their monetary objectives and risk resistance, making certain a sustainable and safe and secure future for their livestock procedures. To conclude, buying LRP Insurance coverage is an aggressive technique for farming manufacturers to attain lasting monetary safety and protect their incomes.

Final Thought

In verdict, Animals Threat Defense (LRP) Insurance coverage is a useful tool for livestock producers to mitigate market threats and safeguard their investments. It is a smart choice for guarding animals financial investments.

Comments on “Safeguarding Success: Bagley Risk Management Services”